Blog

What do the new Equator Principles mean for Biodiversity?

Posted 15th November 2020

What has happened?

What has happened?

On the 1 October 2020, The Equator Principles Association (EPA) updated its Equator Principles (EPs) for the fourth time (Equator Principles 4 or EP4 – you can download a version here [1]).

What are the Equator Principles?

The EPA was established in 2003 and in 2020 is made up of a little over 100 International Financial Institutions (IFIs) from 37 countries (2). IFIs invest through providing debt to international projects across the world. EPA members, Equator Principles Financial Institutions (EPFIs) commit to adopt the EPs in order to manage environmental risks and social issues. Prior to commencement of a Project, a review process occurs. If the EPFI is not satisfied with its client’s commitment to the EPs it can withhold lending or work with the client to ensure the EPs are met. Such Projects may include sectors such as Agribusiness and food production, Chemical manufacturing and processing (including conversion of natural resources such as coal, oil and gas), Forestry, General Manufacturing (for example, refinement, manufacturing and finishing of products made from metals, cements, plastics, paper, glass, electronics, textiles), Infrastructure, Mining, Oil and Gas and Power Projects.

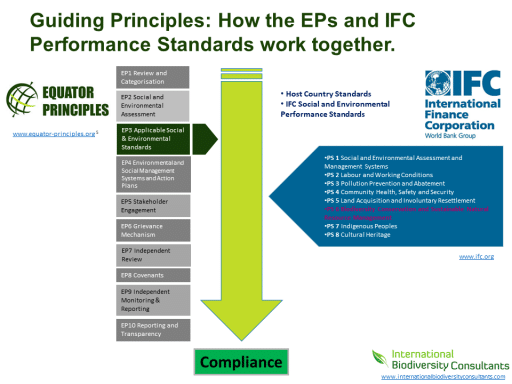

The EPs are made up of 10 principles or guidelines (EP1 to 10) including the Application of Environmental and Social Standards (EP3). EP3 interlinks with the International Finance Corporation (IFC) Performance Standards (see Figure 1). Through the combination of safeguarding standards, the integrity and robustness of the EPs are increased. The last update to the overall EP risk management system occurred in 2013.

Figure 1. How the EPs and IFC Performance Standards work together.

What does it mean for Biodiversity?

The new change with EP4 introduces the potential for EPFIs to encourage their clients to publicly release commercially non-sensitive project-specific biodiversity data via Principle 10 (Reporting and Transparency) (1 and 4). Receiving Institutions includes the Global Biodiversity Information Facility (GBIF) and other global repositories and organizations more local to the Project and relevant to national databases. The purpose here is to encourage greater re-use in future decision-making and research related applications. EPFI clients are now also expected to publish, at a minimum, a summary of their Environmental Social Impact Assessment (ESIA) and make it available online. The ESIA must include a summary of human rights and climate change risks and impacts.

Is it enough?

The United Nation’s Intergovernmental Science-Policy Platform on Biodiversity and Ecosystem Services (IPBES) reported earlier in 2020 that up to 1 million species are now at risk of extinction (5). The report has 145 authors and draws from 15,000 scientific papers. The findings were stark, all kinds of plants, insects, amphibians, mammals covering both terrestrial and marine environments are at risk. It is scientifically proven, that we are in a biodiversity crisis.

Given the background situation, unfortunately the EPA might not have risen to the challenge of ensuring greater protection for biodiversity in terms of their members lending. Earlier in 2020, Portfolio-Earth released new analysis revealing the role the world’s largest banks play in biodiversity impacts (6). With more than US$2.6 trillion in loans and credit provided to primary sectors such as food, forestry, mining, fossil fuels, infrastructure, tourism and transport all identified as primary drivers of the global extinction crisis. EP4 makes clear that many of these sectors are covered by the principles. This is also despite other organisations such as the World Economic Forum (WEF) identifying the links in its Global Risks Report (6).

What more could be done?

A review of stakeholders engaged in reviewing the draft EP4 reveals that despite some sensible suggestions from the Business for Social Responsibility (BSR) these were considered but not included this time. From only two comments of note on biodiversity from all stakeholders, BSR suggested aligning EP4 with IFC PS Guidance Note 6 whereby Projects in some areas will not be acceptable for financing (8).

Portfolio Earth identify the need for greater scrutiny of the financial sector through:

- Risks to the financial industry itself from biodiversity loss;

- Legal implications of biodiversity related liability risks, for example, shareholders protecting their interests or wider moral interests (see work of Client Earth); and

- Increase in investor and shareholder scrutiny is required especially from asset fund managers

Additional recommendations from the Finance for Biodiversity (F4B) include introducing a Finance Accountability Framework including:

- Granting citizens biodiversity rights and preferences through empowerment and enabling biodiversity-related choices for savers, lenders, insurers;

- Greater disclosure of actual and expected biodiversity impacts and risks;

- Liability for Biodiversity whereby robust responses from the legal system tackle biodiversity impacts and act to deter investors and businesses. This would require strengthened legislation extending liability to banks;

- Aligning public finances and increasing transparency of government and public bodies in terms of biodiversity policies, goals and commitments, remove biodiversity-negative subsidies, scale-up with ecological restoration and integrate impact criteria into public procurement;

- Aligning private finances faster and quicker with publicly driven need for change (shared responsibility) through significant strengthening of scrutiny and safeguarding frameworks required;

- Investment values – tipping points are not knew with climate focused changes, however, more emphasis needs to be placed on Natural Capital and ecosystem services; and

- Financial Governance for Biodiversity incorporating assessments on actual and likely impacts of decision-making and negative actions.

More on Finance for Biodiversity Pledge here in this YouTube video.

REFERENCES

- Equator Principles (2020) The Equator Principles July 2020. Accessed at: https://equator-principles.com/wp-content/uploads/2020/05/The-Equator-Principles-July-2020-v2.pdf on 08 November 2020.

- Equator Principles (2020) The Equator Principles. Accessed at: https://equator-principles.com/about/ on 08 November 2020.

- Equator Principles (2020) The Eq6).uator Principles June 2013. Accessed at: https://equator-principles.com/wp-content/uploads/2017/03/equator_principles_III.pdf on 08 November 2020.

- Dawsin, K., Porter, C. and Lutz, S. (2020) Version Four of the Equator Principles: Additional Due Diligence Requirements for Project Financing. Bennet Jones LLP. Accessed at: https://www.bennettjones.com/Blogs-Section/Version-Four-of-the-Equator-Principles-EP4-Additional-Due-Diligence-Requirements

- Vox (2020) A million species are at risk of extinction. Humans are to blame. Accessed at: https://www.vox.com/science-and-health/2019/5/7/18531171/1-million-species-extinction-ipbes-un-biodiversity-crisis on 08 November 2020.

- European Scientist (2020) World’s Banks are funding biodiversity loss and ecosystem construction. Accessed at: https://www.europeanscientist.com/en/environment/banks-are-funding-biodiversity-destruction/ on 08 November 2020.

- Portfolio Earth (2020) Bankrolling Extinction – The Banking Sectors role in the Global Biodiversity Crisis. PDF Report accessed from: https://portfolio.earth/wp-content/uploads/2020/10/Bankrolling-Extinction-Report.pdf on 08 November 2020.

- Equator Principles (2020) Review of the Equator Principles – EP4. Accessed at: https://equator-principles.com/wp-content/uploads/2019/11/EPA-response-to-feedback-received-during-review-of-EPs-11-11-19.pdf on 08 November 2020